Property Tax Oregon

State of Oregon: Property Tax - How property taxes work in Oregon

The property tax system is one of the most important sources of revenue for more than 1,200 local taxing districts in Oregon. Property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and distribute the money to taxing districts.

https://www.oregon.gov/DOR/programs/property/Pages/property-taxes.aspx

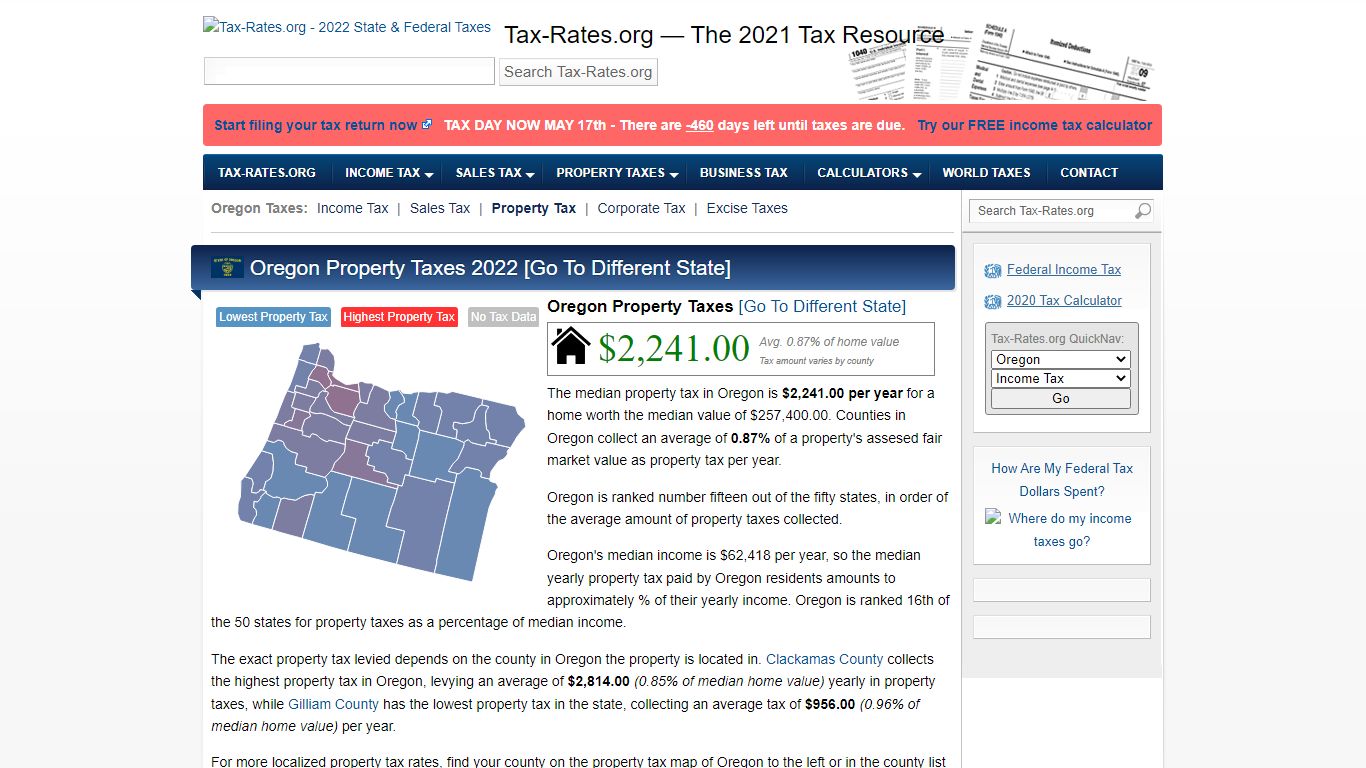

Oregon Property Taxes By County - 2022 - Tax-Rates.org

Avg. 0.87% of home value. Tax amount varies by county. The median property tax in Oregon is $2,241.00 per year for a home worth the median value of $257,400.00. Counties in Oregon collect an average of 0.87% of a property's assesed fair market value as property tax per year. Oregon is ranked number fifteen out of the fifty states, in order of ...

https://www.tax-rates.org/propertytax.php?state=oregon

State of Oregon: Property Tax - Property taxes

Taxpayer training. We're offering training on filing your industrial property return on Tuesday, February 8, 2022 9:00 AM-11:00 AM (UTC-08:00) Pacific Time (US & Canada). Email our property tax training team for more information. Help us improve!

https://www.oregon.gov/DOR/programs/property/Pages/default.aspx

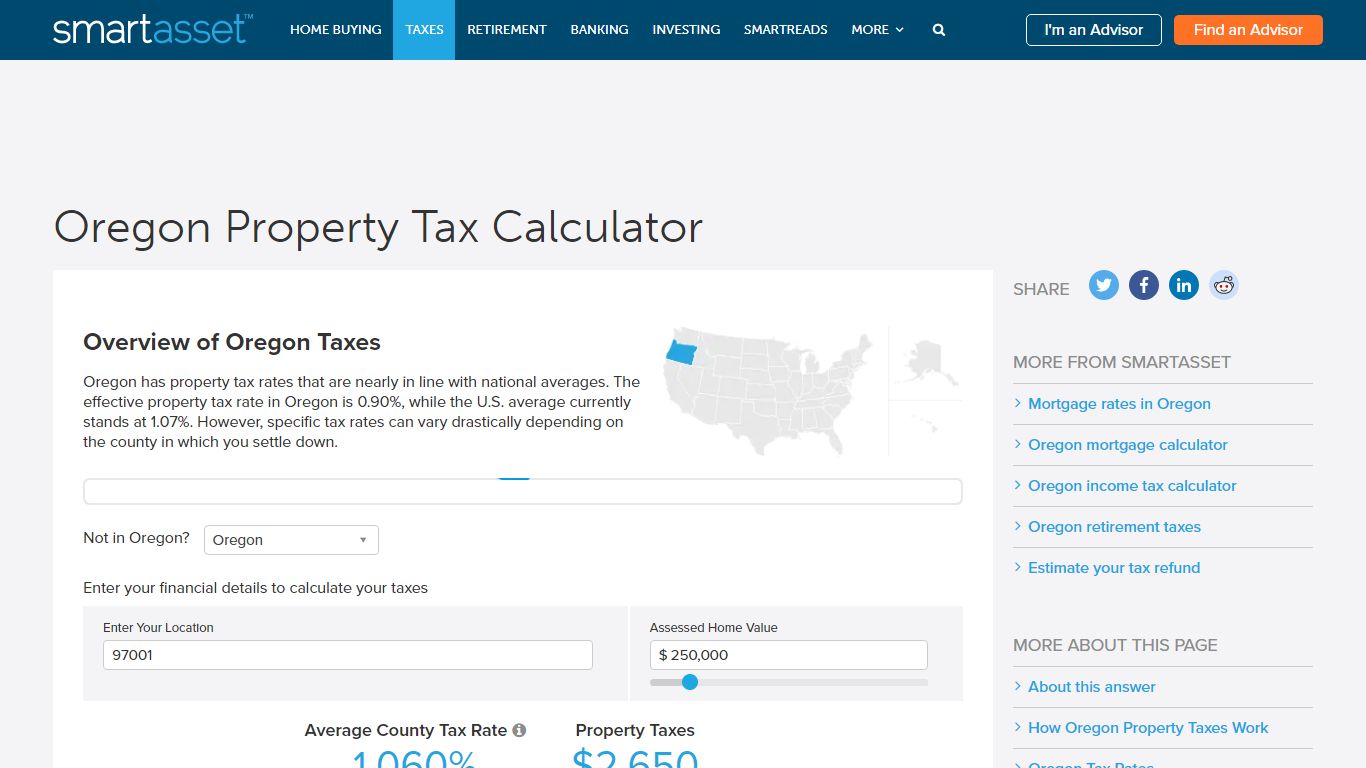

Oregon Property Tax Calculator - SmartAsset

Oregon Property Tax Rates. Just as Oregon limits the value to which tax rates apply, the state also limits tax rates. For any single property, total school district taxes cannot be more than $5 per $1,000 in market value and total general government taxes cannot be more than $10 per $1,000 in market value. (The limits do not apply to bond ...

https://smartasset.com/taxes/oregon-property-tax-calculator

State of Oregon: Property Tax - Personal property assessment and taxation

All personal property must be valued at 100 percent of its real market value unless otherwise exempt (ORS 307.020). Personal property is taxable in the county where it's located as of January 1 at 1 a.m. Personal property is either tangible or intangible. Intangible personal property is not taxable, and tangible personal property may or may not ...

https://www.oregon.gov/DOR/programs/property/Pages/personal-property.aspx

Property Taxes | Multnomah County

Phone 503-988-3326. Email Customer Service [email protected]. Recording [email protected] PO Box 5007 Portland, OR 97208-5007. Business Hours Monday-Friday

https://www.multco.us/assessment-taxation/property-taxes

Assessment & Taxation | Clackamas County

Property Tax Collector and Assessor for Clackamas County. Pay your property taxes, find out your tax lot, learn about tax deferment and exemptions options. ... Oregon Law provides a residential property tax exemption for qualified military service members that exempts up to $96,283 of the assessed value of their home for 2021.

https://www.clackamas.us/at

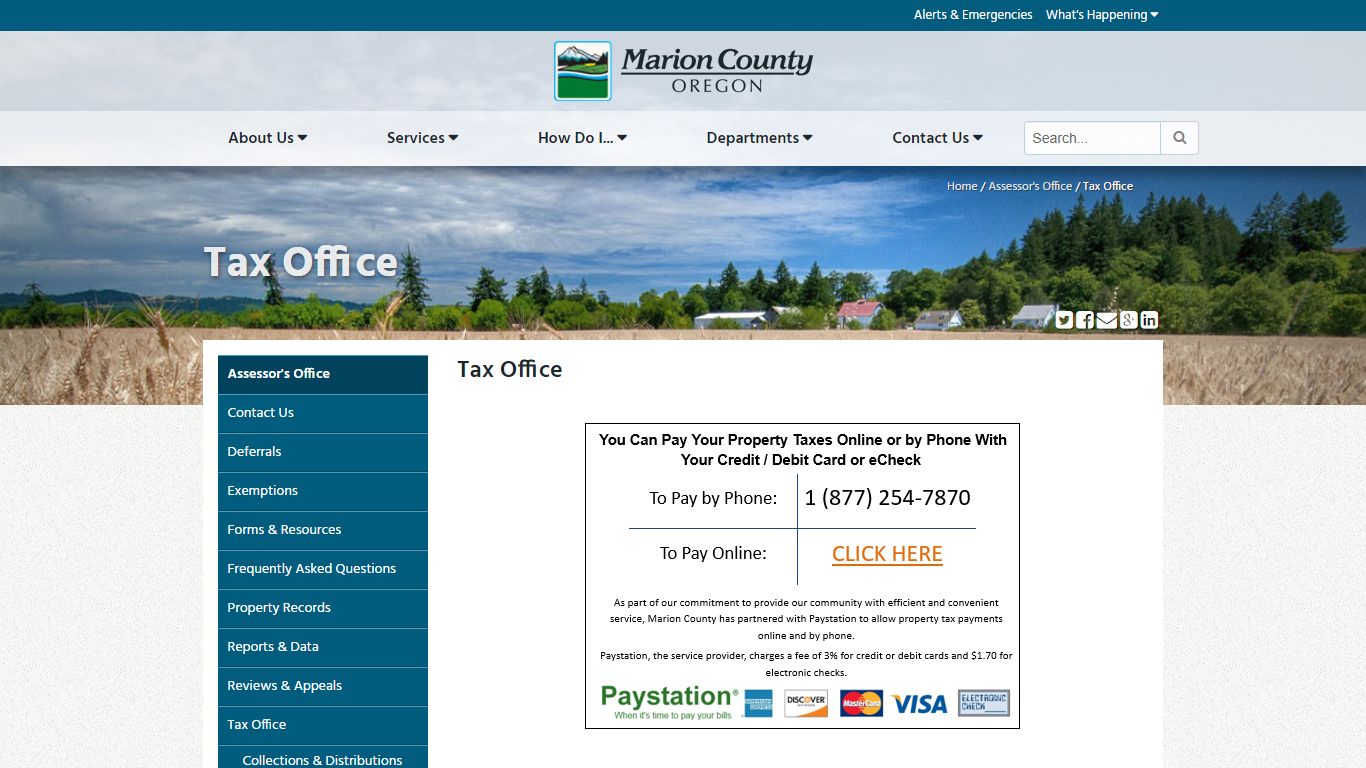

Tax Office - Marion County, Oregon

Office Location: 555 Court St NE Ste. 2242 Salem, OR 97301 . Mailing Address: PO Box 2511 Salem, OR 97308 . Office Hours: 8:00 a.m. - 5:00 p.m. Monday-Friday

https://www.co.marion.or.us/AO/TAX

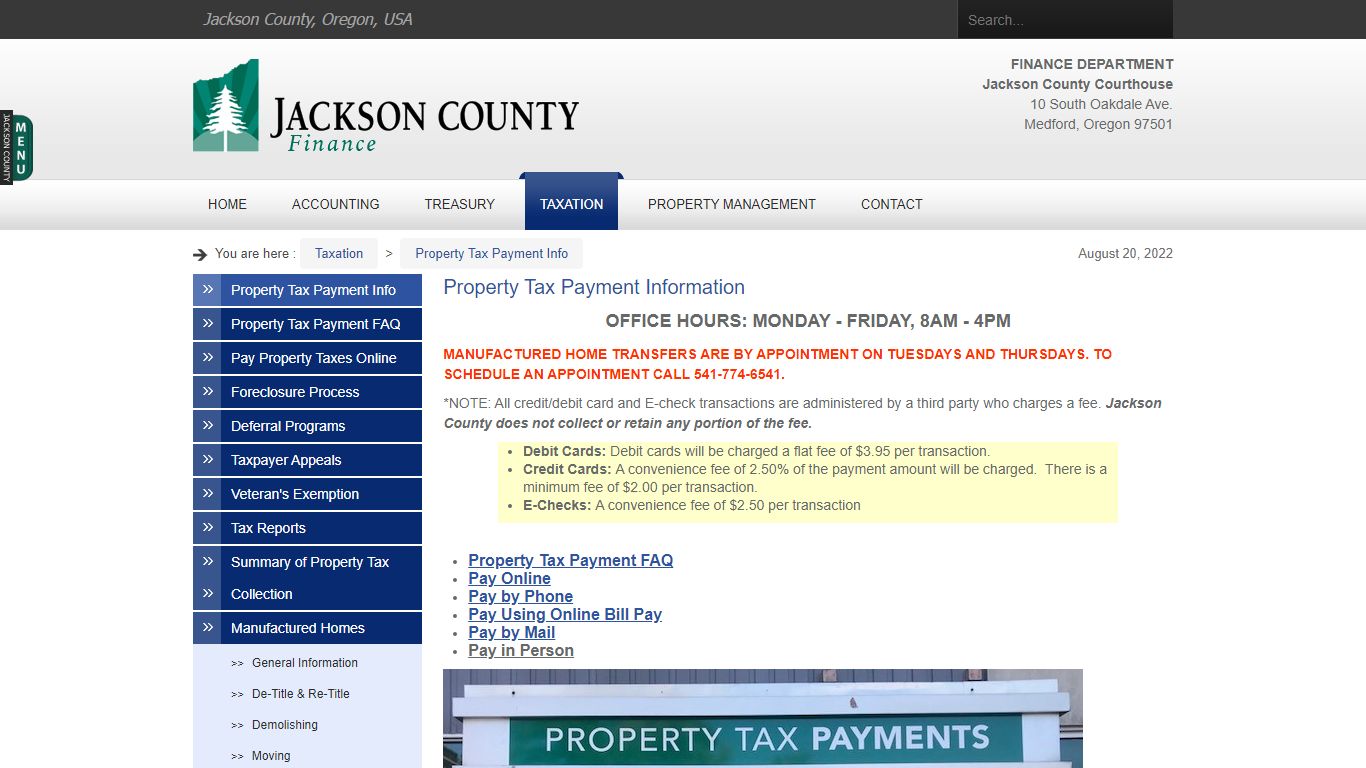

Property Tax Payment Information - Jackson County, Oregon

OFFICE HOURS: MONDAY - FRIDAY, 8AM - 4PM. MANUFACTURED HOME TRANSFERS ARE BY APPOINTMENT ON TUESDAYS AND THURSDAYS. TO SCHEDULE AN APPOINTMENT CALL 541-774-6541. *NOTE: All credit/debit card and E-check transactions are administered by a third party who charges a fee. Jackson County does not collect or retain any portion of the fee.

https://jacksoncountyor.org/finance/Taxation/Property-Tax-Payment-Info

State of Oregon: Oregon Department of Revenue - Home

Everything you need to file and pay your Oregon taxes: instructions for personal income and business tax, tax forms, payment options, and tax account look up. Skip to the main content of the page; Oregon Department of Revenue. Share feedback on proposed 2023-25 budget request ...

https://www.oregon.gov/DOR/Pages/index.aspx